crm accounting takes center stage as a game-changer for businesses looking to merge customer management and financial workflows into a single seamless platform. By uniting CRM and accounting functions, organizations can break down information silos, enhance team collaboration, and create a more holistic view of their operations.

This innovative approach allows sales, customer service, and finance teams to work from the same data, improving accuracy and efficiency across departments. With features like invoicing, payment tracking, and automated reporting, crm accounting helps businesses of all sizes make smarter decisions, improve customer satisfaction, and scale more effectively as they grow.

Introduction to CRM Accounting

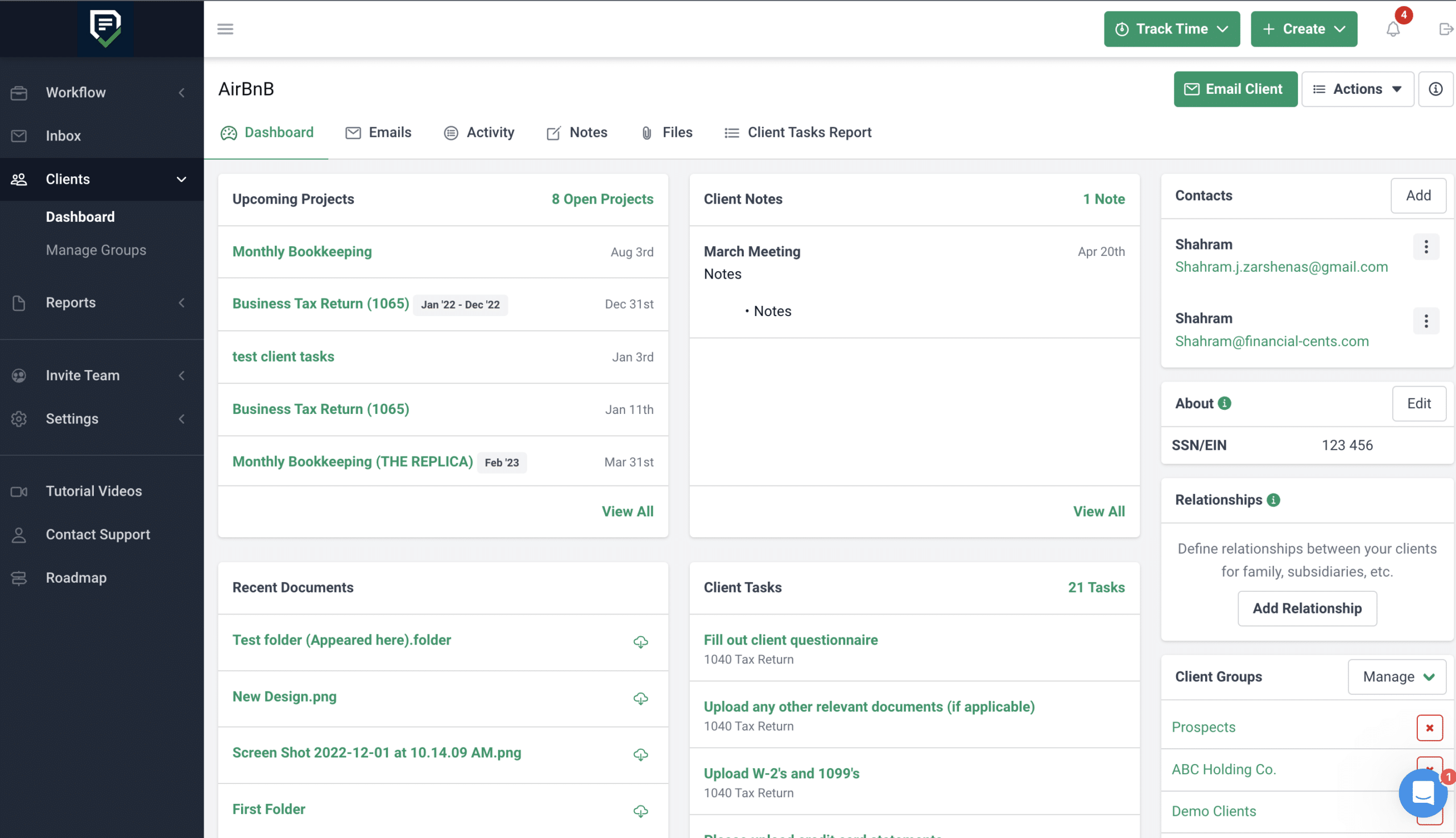

CRM Accounting represents a modern approach where customer relationship management (CRM) capabilities are combined with accounting functionalities into a single, seamless platform. This integration brings together sales, customer service, and finance teams, enabling them to operate collaboratively and efficiently through shared data and automated workflows.

Integrating CRM with accounting systems has become increasingly important for businesses aiming to optimize operations, increase visibility, and enhance customer experiences. By consolidating customer and financial data, companies can provide tailored services, reduce manual errors, and make better-informed decisions. This holistic view empowers organizations to bridge the gap between front-office activities and back-office processes, resulting in improved workflow efficiency across departments.

How CRM Accounting Streamlines Business Workflows

CRM accounting systems streamline workflows by centralizing key business processes. Sales teams can access up-to-date customer purchase histories, while finance departments can track outstanding invoices and payments within the same platform. This interconnectedness accelerates quotes-to-cash cycles and improves responsiveness, ultimately supporting a more agile business environment.

Core Features of CRM Accounting Software

CRM accounting platforms offer a comprehensive suite of features designed to manage both customer interactions and essential financial operations. These tools help businesses automate repetitive tasks, ensure client information is always current, and simplify financial processes from invoicing to reporting.

Essential Capabilities in CRM Accounting Platforms

The most valued features in CRM accounting software typically include invoicing, payment tracking, client management, and analytical reporting. The following table provides an overview of these core features and their relevance:

| Feature | Description | Benefits | Typical Users |

|---|---|---|---|

| Invoicing | Automates invoice creation and delivery | Reduces manual entry, speeds up billing cycles | Finance teams, SMEs |

| Payment Tracking | Monitors payment statuses and balances | Improves cash flow management, reduces overdue receivables | Accountants, sales support |

| Client Management | Centralizes customer data, communications, and histories | Enables personalized service and targeted sales | Sales, customer service |

| Reporting & Analytics | Generates financial and customer reports | Supports informed decision-making with real-time insights | Management, analysts |

Examples of Automated Processes in CRM Accounting

Automation is a key advantage in CRM accounting platforms. Automated billing reminders, recurring invoice scheduling, and instant reconciliation of payments are just a few examples. These systems also support automated data synchronization between sales orders and finance records, ensuring accuracy and saving valuable time for staff.

Benefits of CRM Accounting Integration

Integrating CRM tools with accounting modules delivers significant operational benefits. By connecting customer-facing and finance operations, businesses gain a unified view of transactions, interactions, and financial status. This integration leads to smoother workflows, faster response times, and improved collaboration across departments.

Operational Advantages of Integration

Real-time data sharing between teams is a major advantage, as it eliminates data silos and ensures everyone is working with the latest information. Decision-making becomes more data-driven, and both customer service and financial reporting can adapt quickly to changing circumstances.

- Improved accuracy: Automated data entry and shared records reduce errors from manual processes.

- Increased efficiency: Streamlined workflows minimize repetitive tasks and administrative bottlenecks.

- Enhanced customer satisfaction: Faster responses to inquiries and accurate billing improve the overall client experience.

- Better financial visibility: Real-time reporting supports proactive cash flow and revenue management.

Types of Businesses That Benefit from CRM Accounting

CRM accounting solutions are valuable across a diverse range of industries and business sizes. From startups and small businesses to large enterprises, companies can leverage these systems to address unique operational challenges and scale efficiently.

Common Use Cases by Business Size and Industry

| Industry | CRM Needs | Accounting Needs | Benefit Example |

|---|---|---|---|

| Retail | Customer loyalty tracking, purchase histories | Inventory management, multi-location invoicing | Personalized promotions, real-time sales insights |

| Professional Services | Client communication tracking, appointment scheduling | Project-based billing, expense tracking | Simplified billing, improved client relationships |

| Manufacturing | Distributor relationship management, order tracking | Cost accounting, supplier invoice automation | Accurate order-to-cash cycles, reduced manual entry |

| Startups & SMEs | Lead management, pipeline tracking | Easy invoicing, tax preparation | Faster growth, reduced administrative overhead |

Industry-Specific Value

Service providers, such as consulting firms and agencies, often use CRM accounting to manage client projects and recurring invoices. Manufacturing businesses benefit from integrating order management with inventory and cost tracking, while retail companies use CRM accounting to tailor loyalty programs and promotions based on customer purchase history. As businesses grow, the scalability and automation within these platforms become essential for maintaining accuracy and efficiency across expanding operations.

Conclusion

Bringing together the best of customer relationship management and accounting, crm accounting paves the way for smarter operations and stronger business growth. As technology continues to evolve, adopting an integrated solution ensures that businesses stay agile, competitive, and ready to meet the challenges of tomorrow.

Common Queries

What is crm accounting?

crm accounting is a software solution that integrates customer relationship management features with accounting tools to streamline business operations.

How does crm accounting improve business efficiency?

By combining CRM and accounting, teams can access real-time data, automate processes like invoicing and payments, and collaborate more effectively, reducing manual work and errors.

Can crm accounting software be customized?

Yes, most crm accounting platforms offer customizable modules and add-ons to fit unique business needs and workflows.

Is crm accounting suitable for small businesses?

Absolutely, crm accounting solutions are available for startups, SMEs, and large enterprises, each with tailored features and pricing.

What security measures are included in crm accounting systems?

Modern crm accounting platforms include data encryption, multi-factor authentication, and compliance with industry regulations to protect sensitive information.